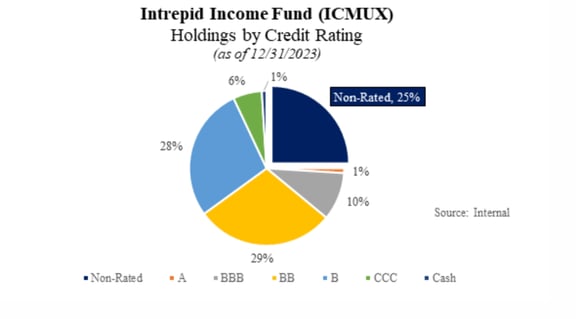

Frequently, clients ask about our position in non-rated (also referred to as unrated) bonds, which often represent one of the largest slices of the Fund’s composition, when categorized by credit rating.

The mystery around these bonds is certainly a conversation starter.

Some clients are very curious and interested in learning more. Others see them as a source of concern, believing they would probably sleep a little better if that slice of the Fund’s pie chart was smaller.

The questions are understandable. Unrated bonds are a niche corner of the credit market that has little traditional Wall Street coverage or academic research for reference. And buying an unrated bond can feel a lot like buying an item on Amazon that doesn’t have any customer reviews – it can be uncomfortable and a lot of investors just won’t do it.

And yet, we have historically found many attractive opportunities in this market niche. Thus, to demystify this type of bond, this blog post will explain:

- What a non-rated bond is

- Why a bond without a credit rating is not always a “red flag”

- How the non-rated bond universe is a potential fertile hunting ground for attractive risk/reward opportunities

- How we approach finding the best opportunities among non-rated bonds

What are Non-Rated (or Unrated) Bonds?

Unrated bonds are simply bonds that do not have a credit rating from any rating agency.

Rating agencies assign their proprietary credit ratings to the fixed income securities of corporations. These ratings convey the differing levels of creditworthiness of each bond. Investors use these ratings as a tool to understand the credit risks and price the securities accordingly. The most common rating agencies are S&P Global Ratings, Moody’s, and Fitch Ratings – all household names in the financial services industry.

The majority of corporate bonds and loans (the same logic applies to both), have credit ratings from these large three players.

However, a portion of the credit market consists of bonds that have no ratings.

Why?

We believe one of the most common reasons is that the company didn’t want to pay for a rating. Yes, rating agencies charge a fee to research a company’s creditworthiness, write a report, and stamp the bond with a letter of the alphabet and their implied “seal of approval.”

A rating can be worth the expense, as many investors rely heavily on these agency ratings in their due diligence process. As a result, rated bonds expand the potential investor pool dramatically, which potentially lowers a company’s cost of capital.

Given the benefits of paying for a credit rating, does that automatically make unrated bonds a bad thing?

Unrated Does Not Equal a “Red Flag”

As always, it depends.

If a company chooses not to pay for a rating because it either can’t afford one or it doesn’t want a third-party research firm bringing investor attention to its challenges, those are, of course, factors to be concerned about.

But in our work in this niche, we have discovered many other reasons that companies choose not to pay for credit ratings – none of which we would put in the “red flag” category. Some common examples:

- They already have relationships with lenders who understand their business well so they don’t need the rating

- The cost of the rating is unreasonably high versus the amount of capital they are trying to raise

- They believe the rating agencies focus too much on characteristics unrelated to creditworthiness, such as sustainability or promoting social justice

- They operate in a small, niche industry that the rating agencies do not cover well and, as a result, have mis-rated the company’s securities in the past

- They have a small finance department and do not have the time or the desire for regular meetings and reporting to ratings agencies in addition to their investors and Board of Directors

To us, these reasons are not “red flags.”

In fact, one can argue that management teams and Boards that thoughtfully decide not to pursue ratings are demonstrating signs of financial strength and/or prudence. They simply don’t believe they need one to raise capital or they conclude that the potential benefits of a rating would not justify the cost.

Either of these decisions reflect qualities we like to see—quite the opposite of a red flag!

A Fertile Hunting Ground

The simple reality of today’s financial market?

Because most bonds have ratings, the ones that don’t are often considered riskier by investors.

As a result, they often trade for higher yields relative to rated bonds with similar levels of credit risk.

Admittedly, credit ratings can make things easy for investors.

Looking for a low-risk place to park some cash? Screen bonds for an investment grade credit rating and easily slot one into your portfolio. Up for something a little riskier? Look for lower-rated debt and you will have just as many available.

Unrated bonds, however, cannot potentially help fulfill such mandates easily. They require deep fundamental work to understand each distinct bond’s risk profile, rather than pulling up a credit rating in seconds.

As a result, unrated bonds are an orphaned corner of the credit market and potentially carry a stigma. Not all Portfolio Managers enjoy discussing them with clients as much as we do! It’s much easier to stick to rated bonds that are believed to have the rating agencies’ well-understood “stamp of approval.”

As discussed above, many companies pay for that designation in part to potentially increase the size of the investor pool, a dynamic that tends to lower their cost of capital. As lenders, we prefer the pool with less investor competition so we can collect that higher cost of capital!

Thus, unrated bonds have always been a major focus of our research efforts and the Fund’s holdings.

Our Approach

Our approach to analyzing unrated bonds is best explained by a story.

In the mid 2000s, a member of our investment team was in a college Real Estate Finance class visited by a guest lecturer: the CEO of a large commercial Real Estate Investment Trust (REIT). He gave the class of impressionable students a thought experiment that day: imagine you were selling a large commercial building and after completing an inspection, the potential buyer pointed out a number of significant problems with the building including a termite infestation, missing permits, and a lack of ADA-compliant bathroom facilities. How would you handle it?

He then asked every student in the lecture to step to the front of the class and briefly explain their approach if they were in charge.

After a classroom full of hilarious and inadequate answers (including the author’s!), the executive provided the right one.

“How in the hell did you not know these things about your property already? You’re going to let someone else point that out to you? What kind of a professional does that?”

His point was great: Why would you ever rely on someone else’s research to determine what you think about an investment? Why would you outsource your analysis? Or base your strong convictions on an outsourced opinion?

Ultimately, while we understand credit ratings serve a purpose for some in the marketplace, they have no role in our research process. As a result, our approach to finding attractive unrated bonds is exactly the same as finding attractive rated bonds – we do the bottom-up fundamental work to understand the true credit risk and compare it to the yield on offer.

In fact, the only time we discuss credit ratings is when we have to make a new pie chart at the end of each quarter.

To summarize, we have no special process to find the “good” unrated bonds. It takes as much hustle and elbow grease as it does to find rated bonds that have attractive risk/reward characteristics.

However, it helps that many investors ignore unrated bonds, preferring to stick to the much larger, more competitive universe of rated bonds. As long as that remains the case, we expect that unrated slice of the pie chart to remain one of the larger ones in the Fund.

Final Thoughts

Like the REIT CEO above, we propose another thought experiment: What if there were no ratings agencies and all bonds were unrated?

We believe such a scenario could create a more efficient credit market, as all investors would be forced to do their own due diligence and not rely on the rating agencies’ “rubber stamp,” which we believe can often be flat-out wrong, focused on the wrong drivers, or very late to react to financial trends.

However, while we could be wrong about that hypothesis, we feel very strongly that the Fund’s future returns be lower if the opposite were true and all bonds had to be rated. Opening up the unrated corner of the market to a larger pool of investors who either require or rely on ratings to do credit work would no doubt shrink our opportunity set.

Instead, we prefer today’s quagmire of a large pool of rated bonds and a small puddle of unrated bonds – it helps promotes misperceptions and inefficiencies that we work hard to take advantage of.

To discuss this topic further, please reach out to our Team at the link below!

Get in Touch

Email Us

Call Us

Subscribe to Our Insights

Mutual fund investing involves risk. Principal loss is possible.

The Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company. Please read it carefully before investing. A hard copy of the prospectus can be requested by calling 866-996-FUND (3863).

Intrepid Capital Management Funds are distributed by Quasar Distributors, LLC.

Investments in debt securities typically decrease in value when interest rates rise. The risk is generally greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher rated securities. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. Diversification does not guarantee a profit or protect from loss in a declining market.

Credit ratings are from, in order of availability, nationally recognized statistical rating organizations (NRSROs) Standard & Poor’s, Moody’s, Fitch, then Egan-Jones. All ratings are standardized using Standard & Poor’s grading system regardless of which rating agency assigned the rating.

Quality ratings reflect the credit quality of the underlying securities in the Fund’s portfolio and not that of the fund itself. Quality ratings are subject to change. S&P assigns a rating of AAA as the highest to D as the lowest credit quality rating.