The post-pandemic macroeconomic paradigm has put considerable pressure on the traditional 60/40 portfolio that investors have used as a cornerstone for asset allocation decisions for decades. During the Great Moderation, the period of low economic volatility spanning from the mid-1980’s to 2007, and the subsequent Goldilocks economy that pushed both stocks and bonds higher in the decade following the Great Financial Crisis, it was widely believed that a core allocation to Treasuries and investment grade corporates would serve as a ballast to portfolios if equities were to experience another bear market. The punishing market ride in 2022, however, undermined conventional wisdom as surging inflation and rising interest rates broke down the relationship between stocks and bonds that investors of all stripes took for granted. 60/40 portfolios fell a whopping 17% last year, waking many investors up to the reality that although the 60/40 portfolio performed well in recent decades, so too did nearly any allocation to risk assets that avoided cash.

A New Approach to Asset Allocation

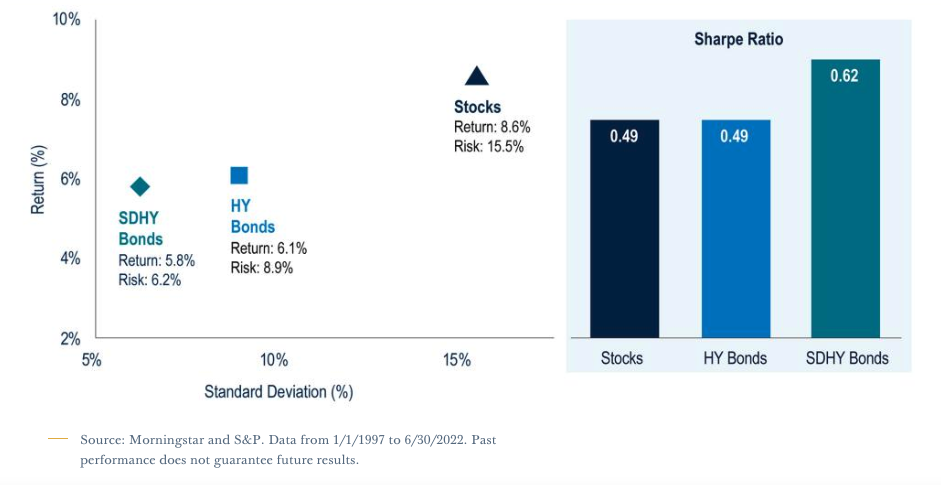

In today’s volatile and uncertain macroeconomic climate, market participants should look beyond the traditional 60/40 portfolio and emphasize more opportunistic investment strategies. Short duration high-yield bonds, long overlooked in most fixed income portfolios, represent an opportunity set that could provide investors with enhanced current income, less interest rate risk, and more equity-like returns compared to Treasuries and investment grade corporates. Their attractive risk-return profile, low correlation to traditional asset classes, and lack of coverage also lend the sector extremely well to active management. In this blog we’ll take a closer look at why we believe short duration high-yield bonds should constitute a core allocation for those looking to eschew macro forecasting and modernize their approach to asset allocation.

A Brief Overview of the High-Yield Market

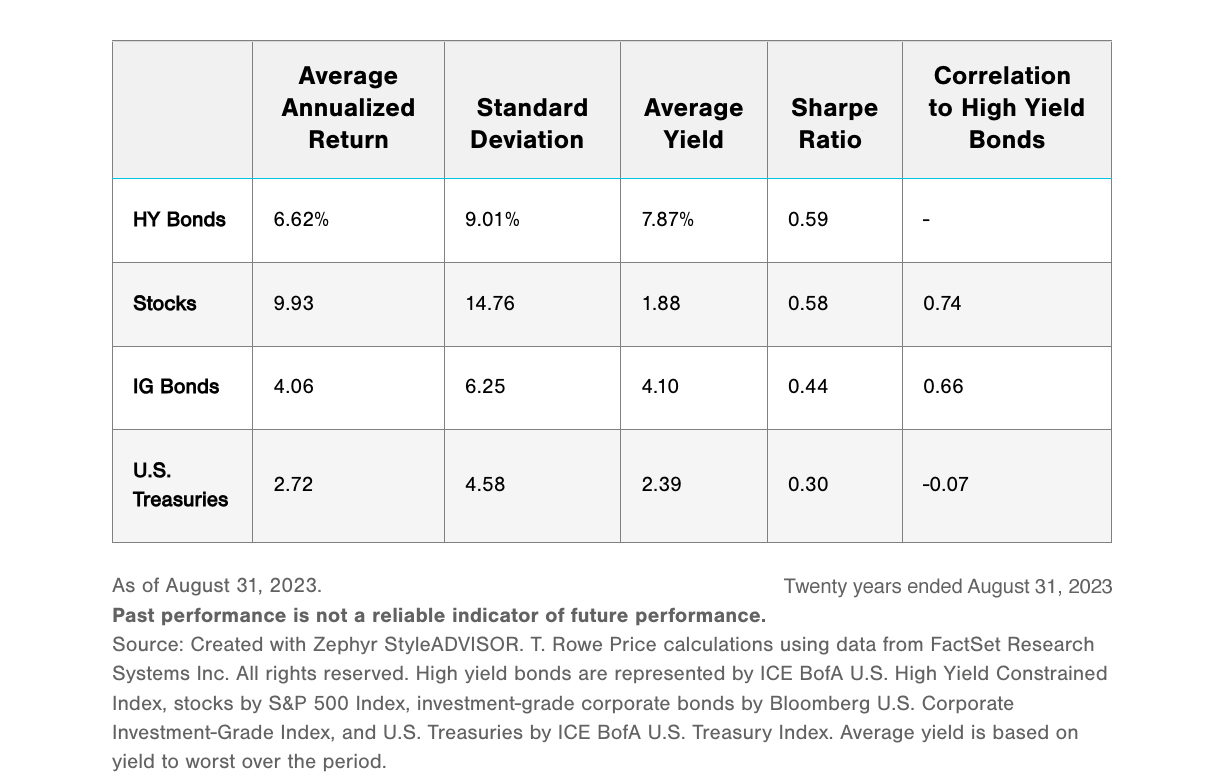

The high-yield bond market has come a long way since the 1970’s, a period when the group was synonymous with “fallen angels,” or bonds that had been downgraded to below-investment grade. The market began to take its current form when Michael Milken and his team at Drexel Burnham Lambert began selling bonds from companies with below-investment grade ratings to finance M&A and leveraged buyouts. As the market evolved, issuers began using high-yield debt for a wider variety of purposes, including financing capital needs, and paying down bank lines of credit. In its relatively short history, the high-yield market at large has served investors well, generating equity-like returns with less volatility than stocks.

Attractive Risk-Adjusted Returns

SDHY Bonds = ICE BofA 1-5 Year BB – B Cash Pay High Yield Index

HY Bonds = ICE BofA U.S. High Yield Constrained Index

Stocks = S&P 500 Index

Sharing features with both stocks and bonds, high-yield bonds can be considered an equity substitute or part of an overall fixed income allocation. Unlike stocks, high-yield bonds generally derive most of their total returns from income rather than capital appreciation; and unlike other fixed income sectors, they are more sensitive to corporate earnings than fluctuations in interest rates.

Diversification Benefits

Because the performance of high-yield bonds is strongly linked to the fundamentals of the companies that issue them, they have limited correlation to other asset classes. An allocation to short duration high-yield can expand the efficient frontiers of investment grade corporate, mortgage-backed, and 10-year treasury portfolios. Alternatively, if considered an equity substitute, they can potentially reduce the volatility of a large-cap equity portfolio with minimal return concession.

Finding the Sweet Spot in Short Duration High-Yield

While high-yield bonds in general tend to have lower durations than other fixed income sectors, due to their higher coupons and shorter maturities, we believe short duration high-yield bonds are especially suitable for investors for the following reasons:

- SDHY bonds typically offer more attractive yields per unit of duration. Investors have not been compensated well for taking on incremental interest rate risk.

- The frequency of maturities in SDHY portfolios creates a high natural turnover and minimizes trading costs for those, like us, who prefer to hold positions to maturity.

- SDHY prices are generally more stable than longer duration high-yield because of the “pull-to-par" effect, but still offer a large yield premium over investment grade bonds.

- SDHY strategies have historically experienced less severe drawdowns than broad-based high-yield indices and the S&P 500 during periods of acute market stress. A recent study by AllianceBernstein indicated that over the 20 years ending September 30, 2022, BB- and B-rated high-yield bonds between one and five years to maturity captured more than 80% of the broader high-yield market return, while experiencing approximately 50% of the average monthly drawdown. This dynamic reduces the potential risk of poor market timing and highlights the value of the strategy as a non-tactical component of a long-term asset allocation.

- Only a small amount of mutual fund assets in high yield bonds are focused on SDHY. Many high-yield investors want more leverage with their research decisions, which favors longer-dated bonds with higher convexity. As a result of this inattention, SDHY bonds often have starting yields on par with longer duration high-yield, with substantially less default risk.

- High-yield issuers often receive a single credit rating for their long and short-term debt, which creates mispricing opportunities.

We are incredibly excited about short duration, high-yield credit as an asset class and its ability to offer attractive upside potential relative to larger and more liquid areas of fixed income markets. To learn more about Intrepid and ICMUX, don’t hesitate to reach out to us with any questions.

Get in Touch

Email Us

Call Us

Subscribe to Our Insights

Index performance does not reflect fund performance, and it is not possible to invest directly in an index. Diversification cannot assure a profit or protect against loss in a down market.

Correlation is statistic that measures the degree to which two securities or indices move in relation to each other.

Standard Deviation is a statistic that measures a security or index’s historical volatility.

Sharpe Ratio is a measure of risk-adjusted return compared to a risk-free investment.

Yield to Worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contracts without defaulting.

Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

Credit Ratings are ratings systems designed to determine the likelihood of a creditor to default on its obligations. Standard & Poor’s is a major credit rating provider. A Standard & Poor’s BB- rating represents a speculative grade rating for a creditor that is deemed less vulnerable in the near term, but faces ongoing uncertainties and exposure to adverse business, financial, or economic conditions. A Standard & Poor’s B- rating represents a speculative grade rating for a creditor that is more vulnerable than BB-, but currently has the capacity to meet its financial commitments.

Drawdown refers to how much an investment is down from the peak before it recovers back to the peak.

Convexity is the curvature in the relationship in the relationship between bond prices and bond yields. For instance, if a bond’s duration increases as yields increase, the bond is said to have negative convexity.

ICE BofA 1-5 Year BB – B Cash Pay High Yield Index tracks the performance of US dollar-denominated corporate debt with ratings between BB and B and that are currently in a coupon paying period.

ICE BofA U.S. High Yield Constrained Index tracks the performance of US dollar-denominated below investment grade corporate debt publicly issued in the US domestic market.

S&P 500 Index is a market capitalization-weighted index of 500 leading publicly traded companies in the United States.

Bloomberg US Corporate Investment Grade Index is a broad-based index measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

ICE BofA US Treasury Index tracks the performance of US dollar-denominated below investment grade corporate debt publicly issued in the US domestic market.

Mutual fund investing involves risk. Principal loss is possible.

The Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company. Please read it carefully before investing. A hard copy of the prospectus can be requested by calling 866-996-FUND (3863).

Intrepid Capital Management Funds are distributed by Quasar Distributors, LLC.