The objective of the Intrepid Income Fund (ICMUX) is high current income and capital appreciation. The Fund seeks to achieve an attractive return profile that outperforms credit indices with reduced volatility and shallower drawdowns. In this blog we’ll describe some of the key drivers behind the fund’s long-term track record and why we believe the strategy remains well-positioned to flourish no matter what the future may bring.

A Conservative, Macro-agnostic Approach

Winston Churchill’s observation that “it’s always wise to look ahead, but difficult to look further than we can see” aptly sums up our team’s philosophy on underwriting. Our conservative and opportunistic approach lends itself to shorter duration issues. We categorically avoid long-term forecasting and instead concentrate our efforts on disciplined short-to-medium term assessments of issuer cash flows and loan-to-value ratios.

A pleasant side-effect of our approach is that ICMUX is effectively macro-agnostic. Unlike most of our peers who attempt to forecast inflation, Fed actions, interest rates, and the like, we instead rely solely on our core competency: underwriting credit risk and identifying attractive risk/reward opportunities that have the potential to withstand a variety of economic scenarios. With our high natural turnover from our portfolio of short duration holdings and a mandate that grants us the flexibility to rotate into different pockets of fixed income, we’re able to efficiently respond to a changing opportunity set while maintaining a predictable and minimal amount of potential interest rate risk for our clients.

Portfolio Construction – The Boutique Advantage

The small size of ICMUX ($343M as of 6/30/23) allows us to target less fished-in waters that contain more attractive opportunities from a risk/reward standpoint. In a recent blog, we examined the constraints larger managers face with respect to small cap issues, as well as some popular misconceptions about liquidity which, to our benefit, have often resulted in greater inefficiencies in the small-cap side of the high-yield market. With our rigorous research, all of which we do in-house, we’re often able to pick up higher yields for the same, or lower, credit risk than our competitors due to our small size. And we believe this advantage has a long trajectory – our research suggests ICMUX can grow to approximately $5 billion in size without compromising this core value proposition.

In general, we seek out issuers with recession-resistant business models in capital-constrained sectors. Our portfolio does not resemble any index and typically contains between 30-70 positions with an average issue size of ~$391MM. While our focus is on high-yield bonds, we will also purchase investment grade bonds, loans, and convertibles depending on relative valuations and various other market factors.

Proof is in the Pudding

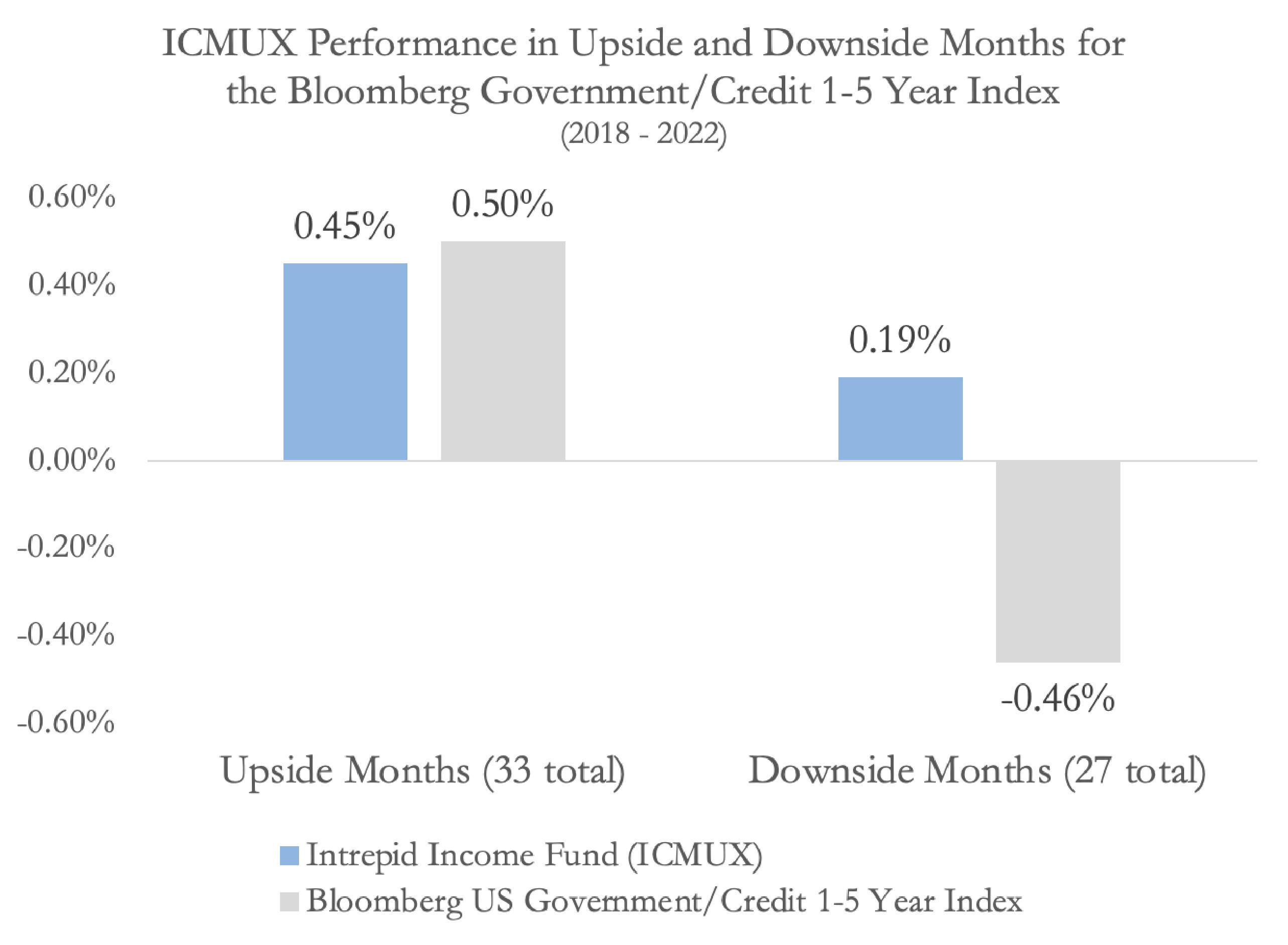

We’re proud of our long-term track record that highlights, above all, our highly disciplined credit research. We’ve demonstrated an ability to keep up with our benchmarks in periods of strength in the high-yield market, but more importantly, from our perspective, an ability to cushion downside risk when fixed income markets are under stress.

While past performance is no indication of future results, we believe the nature of ICMUX is most clearly expressed by the fund’s performance relative to the benchmark Bloomberg US Government/Credit 1-5 Year Index. In the five years between 2018 and 2022, during months where this Index had positive returns (“upside months”), ICMUX’s performance generated a large percentage of the upside the index provided. During months between 2018 and 2022 where the Index had a negative return (“downside months”), ICMUX actually generated a positive return. Both the upside and downside returns for ICMUX and the Index are shown in the chart below and are each calculated using the geometric averages.

Source: Bloomberg

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less risk their original cost. Current performance may be lower or higher than the performance data quoted. For current performance, click here.

Conclusion

Whether the present interest rate environment is secular or transitory, we believe ICMUX can, depending on our investors’ desired exposure to interest rate and credit risk, serve effectively either i) as a core fixed income holding or ii) as a complement to a more traditional core allocation of longer-duration investment grade bonds. The fund’s combination of high current yield, low duration, and high-quality credits results in a constructive holding in any macroeconomic scenario.

For more information about ICMUX and Intrepid, please reach out to us with any questions.

Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

Loan-to-value (LTV) ratio is an assessment of lending risk that compares the value of available collateral to the amount of debt obligations encumbering that collateral.

The Bloomberg US Gov/Credit 1-5Y TR Index measures the performance of U.S. dollar-denominated U.S. Treasury bonds, government-related bonds, and investment grade U.S. corporate bonds that have a remaining maturity of greater than or equal to one year and less than five years.

Mutual fund investing involves risk. Principal loss is possible.

The Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company. Please read it carefully before investing. A hard copy of the prospectus can be requested by calling 866-996-FUND (3863).

Intrepid Capital Management Funds are distributed by Quasar Distributors, LLC.